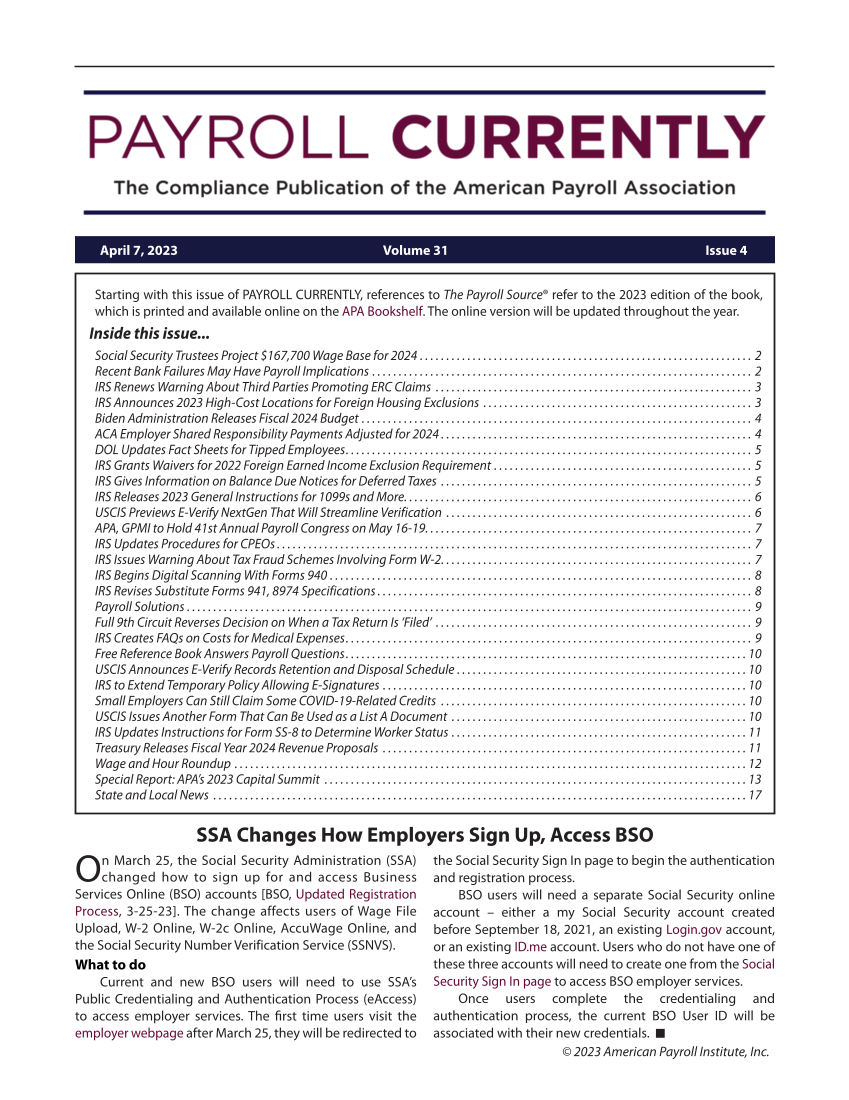

© 2023 American Payroll Institute, Inc. Starting with this issue of PAYROLL CURRENTLY, references to The Payroll Source® refer to the 2023 edition of the book, which is printed and available online on the APA Bookshelf. The online version will be updated throughout the year. Inside this issue... Social Security Trustees Project $167,700 Wage Base for 2024. ...............................................................2 Recent Bank Failures May Have Payroll Implications. ........................................................................2 IRS Renews Warning About Third Parties Promoting ERC Claims. ............................................................3 IRS Announces 2023 High-Cost Locations for Foreign Housing Exclusions. ...................................................3 Biden Administration Releases Fiscal 2024 Budget. ..........................................................................4 ACA Employer Shared Responsibility Payments Adjusted for 2024 ...........................................................4 DOL Updates Fact Sheets for Tipped Employees. ............................................................................5 IRS Grants Waivers for 2022 Foreign Earned Income Exclusion Requirement. .................................................5 IRS Gives Information on Balance Due Notices for Deferred Taxes. ...........................................................5 IRS Releases 2023 General Instructions for 1099s and More. .................................................................6 USCIS Previews E-Verify NextGen That Will Streamline Verification. ..........................................................6 APA, GPMI to Hold 41st Annual Payroll Congress on May 16-19. .............................................................7 IRS Updates Procedures for CPEOs ..........................................................................................7 IRS Issues Warning About Tax Fraud Schemes Involving Form W-2. ..........................................................7 IRS Begins Digital Scanning With Forms 940. ................................................................................8 IRS Revises Substitute Forms 941, 8974 Specifications .......................................................................8 Payroll Solutions. ...........................................................................................................9 Full 9th Circuit Reverses Decision on When a Tax Return Is ‘Filed’. ............................................................9 IRS Creates FAQs on Costs for Medical Expenses. ............................................................................9 Free Reference Book Answers Payroll Questions. ...........................................................................10 USCIS Announces E-Verify Records Retention and Disposal Schedule. .......................................................10 IRS to Extend Temporary Policy Allowing E-Signatures. .....................................................................10 Small Employers Can Still Claim Some COVID-19-Related Credits. ..........................................................10 USCIS Issues Another Form That Can Be Used as a List A Document. ........................................................10 IRS Updates Instructions for Form SS-8 to Determine Worker Status. ........................................................11 Treasury Releases Fiscal Year 2024 Revenue Proposals. .....................................................................11 Wage and Hour Roundup. .................................................................................................12 Special Report: APA’s 2023 Capital Summit. ................................................................................13 State and Local News. .....................................................................................................17 April 7, 2023 Volume 31 Issue 4 SSA Changes How Employers Sign Up, Access BSO On March 25, the Social Security Administration (SSA) changed how to sign up for and access Business Services Online (BSO) accounts [BSO, Updated Registration Process, 3-25-23]. The change affects users of Wage File Upload, W-2 Online, W-2c Online, AccuWage Online, and the Social Security Number Verification Service (SSNVS). What to do Current and new BSO users will need to use SSA’s Public Credentialing and Authentication Process (eAccess) to access employer services. The first time users visit the employer webpage after March 25, they will be redirected to the Social Security Sign In page to begin the authentication and registration process. BSO users will need a separate Social Security online account – either a my Social Security account created before September 18, 2021, an existing Login.gov account, or an existing ID.me account. Users who do not have one of these three accounts will need to create one from the Social Security Sign In page to access BSO employer services. Once users complete the credentialing and authentication process, the current BSO User ID will be associated with their new credentials.

Printed for: PayrollOrg Bookshelf © 2024 American Payroll Institute, Inc. All rights reserved. From: PayrollOrg Digital Publications (bookshelf.payroll.org)