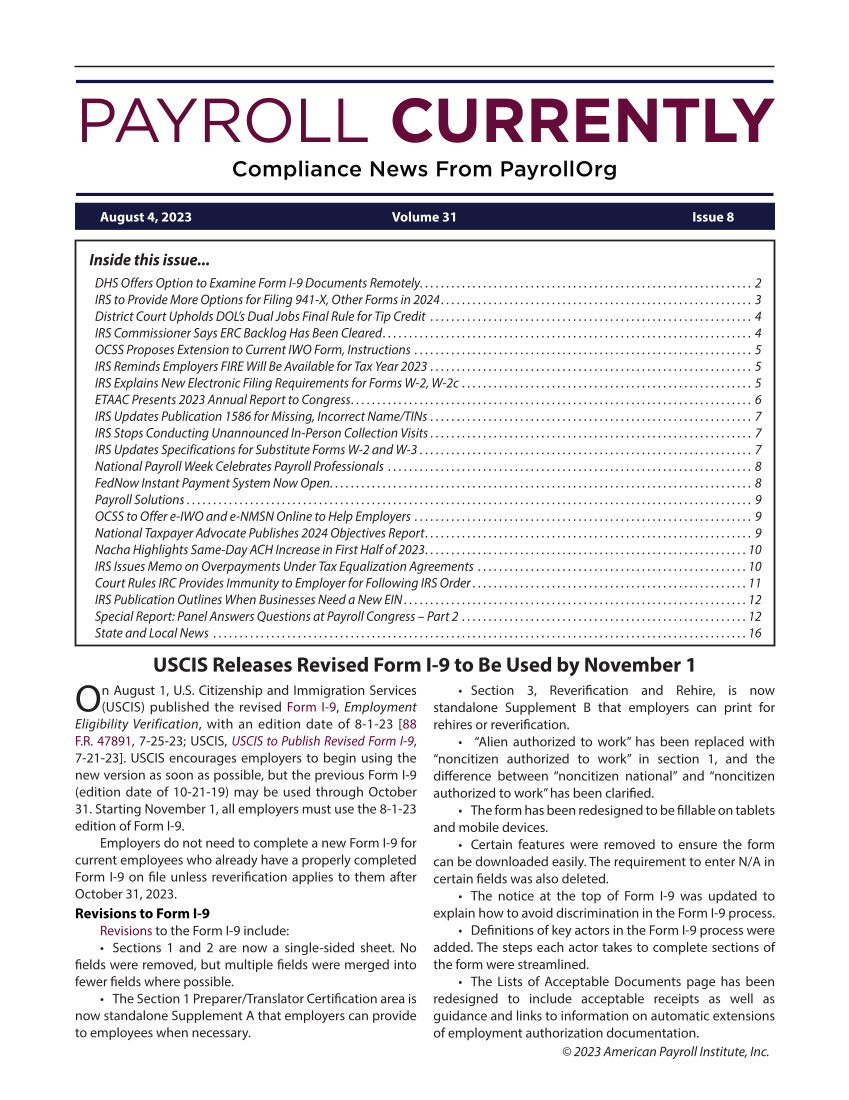

© 2023 American Payroll Institute, Inc. Inside this issue... DHS Offers Option to Examine Form I-9 Documents Remotely. ..............................................................2 IRS to Provide More Options for Filing 941-X, Other Forms in 2024 ...........................................................3 District Court Upholds DOL’s Dual Jobs Final Rule for Tip Credit. .............................................................4 IRS Commissioner Says ERC Backlog Has Been Cleared. .....................................................................4 OCSS Proposes Extension to Current IWO Form, Instructions. ................................................................5 IRS Reminds Employers FIRE Will Be Available for Tax Year 2023. .............................................................5 IRS Explains New Electronic Filing Requirements for Forms W-2, W-2c. .......................................................5 ETAAC Presents 2023 Annual Report to Congress. ...........................................................................6 IRS Updates Publication 1586 for Missing, Incorrect Name/TINs. .............................................................7 IRS Stops Conducting Unannounced In-Person Collection Visits. .............................................................7 IRS Updates Specifications for Substitute Forms W-2 and W-3. ...............................................................7 National Payroll Week Celebrates Payroll Professionals. .....................................................................8 FedNow Instant Payment System Now Open. ...............................................................................8 Payroll Solutions. ...........................................................................................................9 OCSS to Offer e-IWO and e-NMSN Online to Help Employers. ................................................................9 National Taxpayer Advocate Publishes 2024 Objectives Report. .............................................................9 Nacha Highlights Same-Day ACH Increase in First Half of 2023. ............................................................10 IRS Issues Memo on Overpayments Under Tax Equalization Agreements. ...................................................10 Court Rules IRC Provides Immunity to Employer for Following IRS Order. ....................................................11 IRS Publication Outlines When Businesses Need a New EIN .................................................................12 Special Report: Panel Answers Questions at Payroll Congress – Part 2 ......................................................12 State and Local News. .....................................................................................................16 August 4, 2023 Volume 31 Issue 8 USCIS Releases Revised Form I-9 to Be Used by November 1 On August 1, U.S. Citizenship and Immigration Services (USCIS) published the revised Form I-9, Employment Eligibility Verification, with an edition date of 8-1-23 [88 F.R. 47891, 7-25-23 USCIS, USCIS to Publish Revised Form I-9, 7-21-23]. USCIS encourages employers to begin using the new version as soon as possible, but the previous Form I-9 (edition date of 10-21-19) may be used through October 31. Starting November 1, all employers must use the 8-1-23 edition of Form I-9. Employers do not need to complete a new Form I-9 for current employees who already have a properly completed Form I-9 on file unless reverification applies to them after October 31, 2023. Revisions to Form I-9 Revisions to the Form I-9 include: • Sections 1 and 2 are now a single-sided sheet. No fields were removed, but multiple fields were merged into fewer fields where possible. • The Section 1 Preparer/Translator Certification area is now standalone Supplement A that employers can provide to employees when necessary. • Section 3, Reverification and Rehire, is now standalone Supplement B that employers can print for rehires or reverification. • “Alien authorized to work” has been replaced with “noncitizen authorized to work” in section 1, and the difference between “noncitizen national” and “noncitizen authorized to work” has been clarified. • The form has been redesigned to be fillable on tablets and mobile devices. • Certain features were removed to ensure the form can be downloaded easily. The requirement to enter N/A in certain fields was also deleted. • The notice at the top of Form I-9 was updated to explain how to avoid discrimination in the Form I-9 process. • Definitions of key actors in the Form I-9 process were added. The steps each actor takes to complete sections of the form were streamlined. • The Lists of Acceptable Documents page has been redesigned to include acceptable receipts as well as guidance and links to information on automatic extensions of employment authorization documentation.

Printed for: PayrollOrg Bookshelf © 2024 American Payroll Institute, Inc. All rights reserved. From: PayrollOrg Digital Publications (bookshelf.payroll.org)