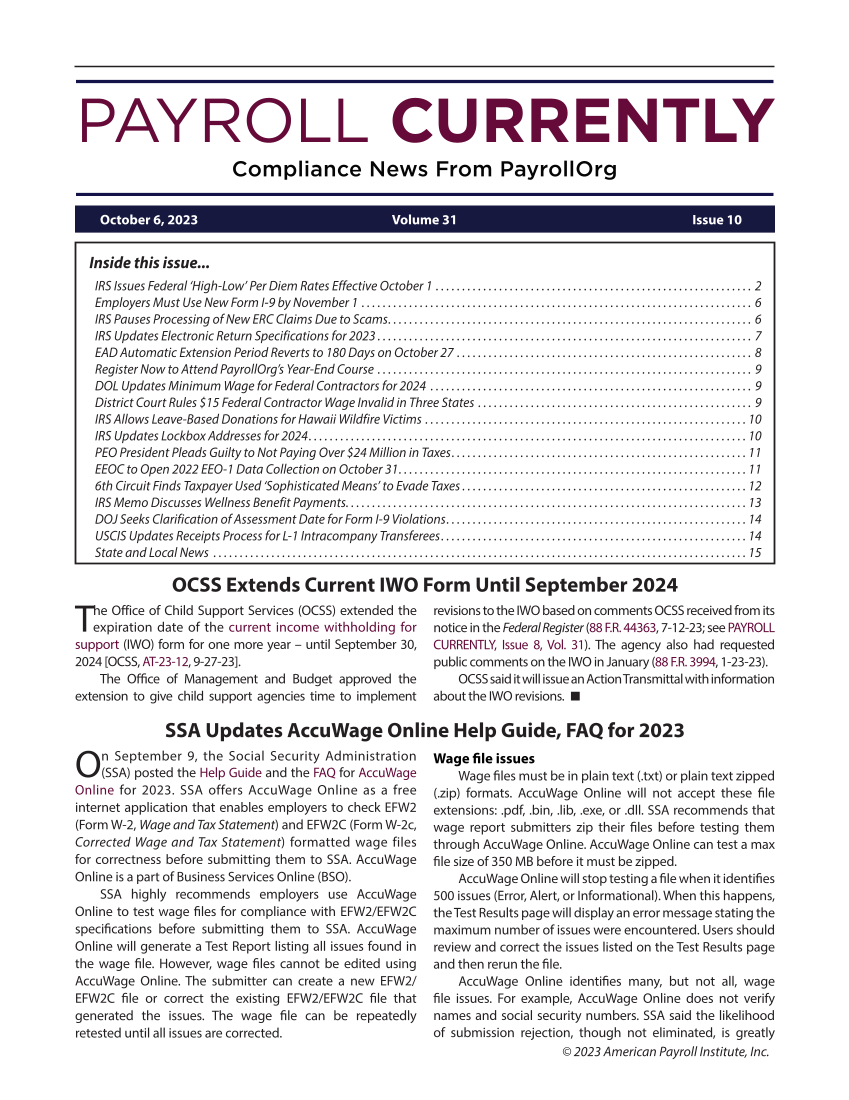

© 2023 American Payroll Institute, Inc. Inside this issue... IRS Issues Federal ‘High-Low’ Per Diem Rates Effective October 1. ............................................................2 Employers Must Use New Form I-9 by November 1. ..........................................................................6 IRS Pauses Processing of New ERC Claims Due to Scams. ....................................................................6 IRS Updates Electronic Return Specifications for 2023 .......................................................................7 EAD Automatic Extension Period Reverts to 180 Days on October 27. ........................................................8 Register Now to Attend PayrollOrg’s Year-End Course. .......................................................................9 DOL Updates Minimum Wage for Federal Contractors for 2024. .............................................................9 District Court Rules $15 Federal Contractor Wage Invalid in Three States. ....................................................9 IRS Allows Leave-Based Donations for Hawaii Wildfire Victims. .............................................................10 IRS Updates Lockbox Addresses for 2024. ..................................................................................10 PEO President Pleads Guilty to Not Paying Over $24 Million in Taxes. .......................................................11 EEOC to Open 2022 EEO-1 Data Collection on October 31. .................................................................11 6th Circuit Finds Taxpayer Used ‘Sophisticated Means’ to Evade Taxes ......................................................12 IRS Memo Discusses Wellness Benefit Payments. ...........................................................................13 DOJ Seeks Clarification of Assessment Date for Form I-9 Violations. ........................................................14 USCIS Updates Receipts Process for L-1 Intracompany Transferees. .........................................................14 State and Local News. .....................................................................................................15 October 6, 2023 Volume 31 Issue 10 OCSS Extends Current IWO Form Until September 2024 The Office of Child Support Services (OCSS) extended the expiration date of the current income withholding for support (IWO) form for one more year – until September 30, 2024 [OCSS, AT-23-12, 9-27-23]. The Office of Management and Budget approved the extension to give child support agencies time to implement revisions to the IWO based on comments OCSS received from its notice in the Federal Register (88 F.R. 44363, 7-12-23 see PAYROLL CURRENTLY, Issue 8, Vol. 31). The agency also had requested public comments on the IWO in January (88 F.R. 3994, 1-23-23). OCSS said it will issue an Action Transmittal with information about the IWO revisions. SSA Updates AccuWage Online Help Guide, FAQ for 2023 On September 9, the Social Security Administration (SSA) posted the Help Guide and the FAQ for AccuWage Online for 2023. SSA offers AccuWage Online as a free internet application that enables employers to check EFW2 (Form W-2, Wage and Tax Statement) and EFW2C (Form W-2c, Corrected Wage and Tax Statement) formatted wage files for correctness before submitting them to SSA. AccuWage Online is a part of Business Services Online (BSO). SSA highly recommends employers use AccuWage Online to test wage files for compliance with EFW2/EFW2C specifications before submitting them to SSA. AccuWage Online will generate a Test Report listing all issues found in the wage file. However, wage files cannot be edited using AccuWage Online. The submitter can create a new EFW2/ EFW2C file or correct the existing EFW2/EFW2C file that generated the issues. The wage file can be repeatedly retested until all issues are corrected. Wage file issues Wage files must be in plain text (.txt) or plain text zipped (.zip) formats. AccuWage Online will not accept these file extensions: .pdf, .bin, .lib, .exe, or .dll. SSA recommends that wage report submitters zip their files before testing them through AccuWage Online. AccuWage Online can test a max file size of 350 MB before it must be zipped. AccuWage Online will stop testing a file when it identifies 500 issues (Error, Alert, or Informational). When this happens, the Test Results page will display an error message stating the maximum number of issues were encountered. Users should review and correct the issues listed on the Test Results page and then rerun the file. AccuWage Online identifies many, but not all, wage file issues. For example, AccuWage Online does not verify names and social security numbers. SSA said the likelihood of submission rejection, though not eliminated, is greatly

Printed for: PayrollOrg Bookshelf © 2024 American Payroll Institute, Inc. All rights reserved. From: PayrollOrg Digital Publications (bookshelf.payroll.org)