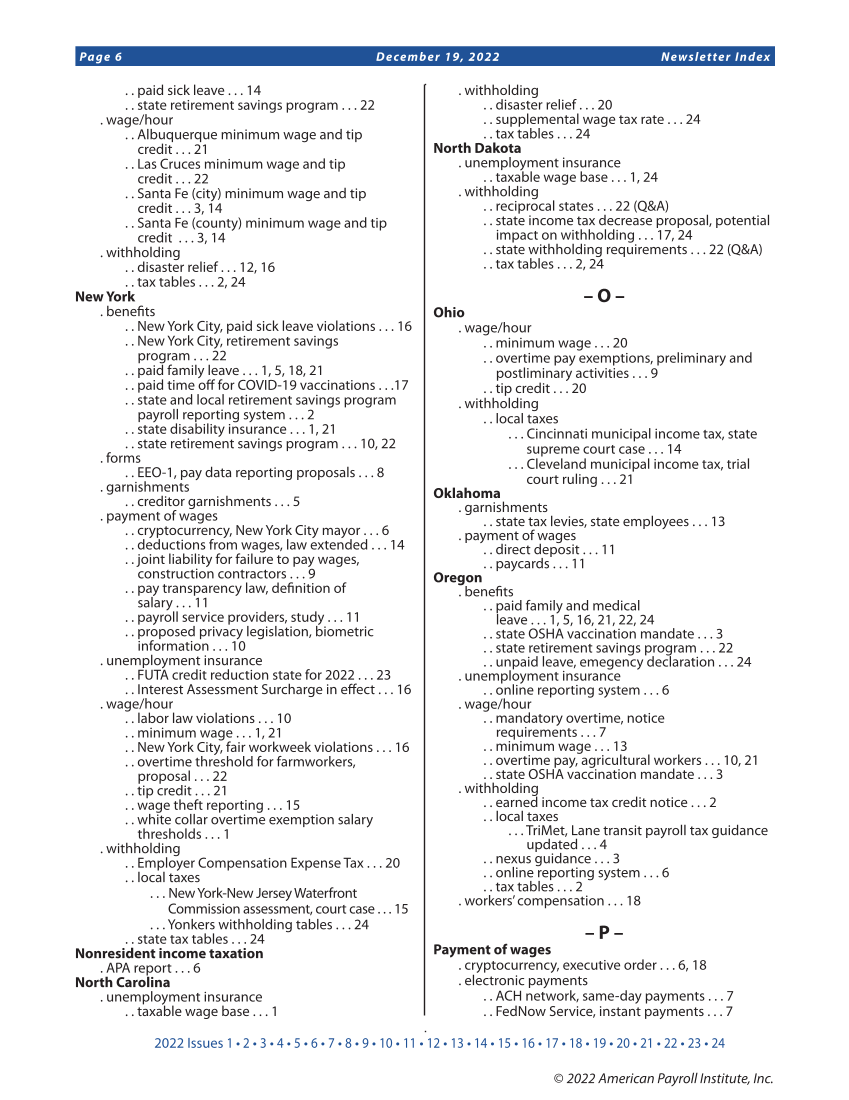

2022 Issues 1 • 2 • 3 • 4 • 5 • 6 • 7 • 8 • 9 • 10 • 11 • 12 • 13 • 14 • 15 • 16 • 17 • 18 • 19 • 20 • 21 • 22 • 23 • 24 Page 6 December 19, 2022 Newsletter Index © 2022 American Payroll Institute, Inc. . . paid sick leave . . . 14 . . state retirement savings program . . . 22 . wage/hour . . Albuquerque minimum wage and tip credit . . . 21 . . Las Cruces minimum wage and tip credit . . . 22 . . Santa Fe (city) minimum wage and tip credit . . . 3, 14 . . Santa Fe (county) minimum wage and tip credit . . . 3, 14 . withholding . . disaster relief . . . 12, 16 . . tax tables . . . 2, 24 New York . benefits . . New York City, paid sick leave violations . . . 16 . . New York City, retirement savings program . . . 22 . . paid family leave . . . 1, 5, 18, 21 . . paid time off for COVID-19 vaccinations . . .17 . . state and local retirement savings program payroll reporting system . . . 2 . . state disability insurance . . . 1, 21 . . state retirement savings program . . . 10, 22 . forms . . EEO-1, pay data reporting proposals . . . 8 . garnishments . . creditor garnishments . . . 5 . payment of wages . . cryptocurrency, New York City mayor . . . 6 . . deductions from wages, law extended . . . 14 . . joint liability for failure to pay wages, construction contractors . . . 9 . . pay transparency law, definition of salary . . . 11 . . payroll service providers, study . . . 11 . . proposed privacy legislation, biometric information . . . 10 . unemployment insurance . . FUTA credit reduction state for 2022 . . . 23 . . Interest Assessment Surcharge in effect . . . 16 . wage/hour . . labor law violations . . . 10 . . minimum wage . . . 1, 21 . . New York City, fair workweek violations . . . 16 . . overtime threshold for farmworkers, proposal . . . 22 . . tip credit . . . 21 . . wage theft reporting . . . 15 . . white collar overtime exemption salary thresholds . . . 1 . withholding . . Employer Compensation Expense Tax . . . 20 . . local taxes . . . New York-New Jersey Waterfront Commission assessment, court case . . . 15 . . . Yonkers withholding tables . . . 24 . . state tax tables . . . 24 Nonresident income taxation . APA report . . . 6 North Carolina . unemployment insurance . . taxable wage base . . . 1 . withholding . . disaster relief . . . 20 . . supplemental wage tax rate . . . 24 . . tax tables . . . 24 North Dakota . unemployment insurance . . taxable wage base . . . 1, 24 . withholding . . reciprocal states . . . 22 (Q&A) . . state income tax decrease proposal, potential impact on withholding . . . 17, 24 . . state withholding requirements . . . 22 (Q&A) . . tax tables . . . 2, 24 – O – Ohio . wage/hour . . minimum wage . . . 20 . . overtime pay exemptions, preliminary and postliminary activities . . . 9 . . tip credit . . . 20 . withholding . . local taxes . . . Cincinnati municipal income tax, state supreme court case . . . 14 . . . Cleveland municipal income tax, trial court ruling . . . 21 Oklahoma . garnishments . . state tax levies, state employees . . . 13 . payment of wages . . direct deposit . . . 11 . . paycards . . . 11 Oregon . benefits . . paid family and medical leave . . . 1, 5, 16, 21, 22, 24 . . state OSHA vaccination mandate . . . 3 . . state retirement savings program . . . 22 . . unpaid leave, emegency declaration . . . 24 . unemployment insurance . . online reporting system . . . 6 . wage/hour . . mandatory overtime, notice requirements . . . 7 . . minimum wage . . . 13 . . overtime pay, agricultural workers . . . 10, 21 . . state OSHA vaccination mandate . . . 3 . withholding . . earned income tax credit notice . . . 2 . . local taxes . . . TriMet, Lane transit payroll tax guidance updated . . . 4 . . nexus guidance . . . 3 . . online reporting system . . . 6 . . tax tables . . . 2 . workers’ compensation . . . 18 – P – Payment of wages . cryptocurrency, executive order . . . 6, 18 . electronic payments . . ACH network, same-day payments . . . 7 . . FedNow Service, instant payments . . . 7

Printed for: PayrollOrg Bookshelf © 2024 American Payroll Institute, Inc. All Rights reserved. From: PayrollOrg Digital Publications (bookshelf.payroll.org)