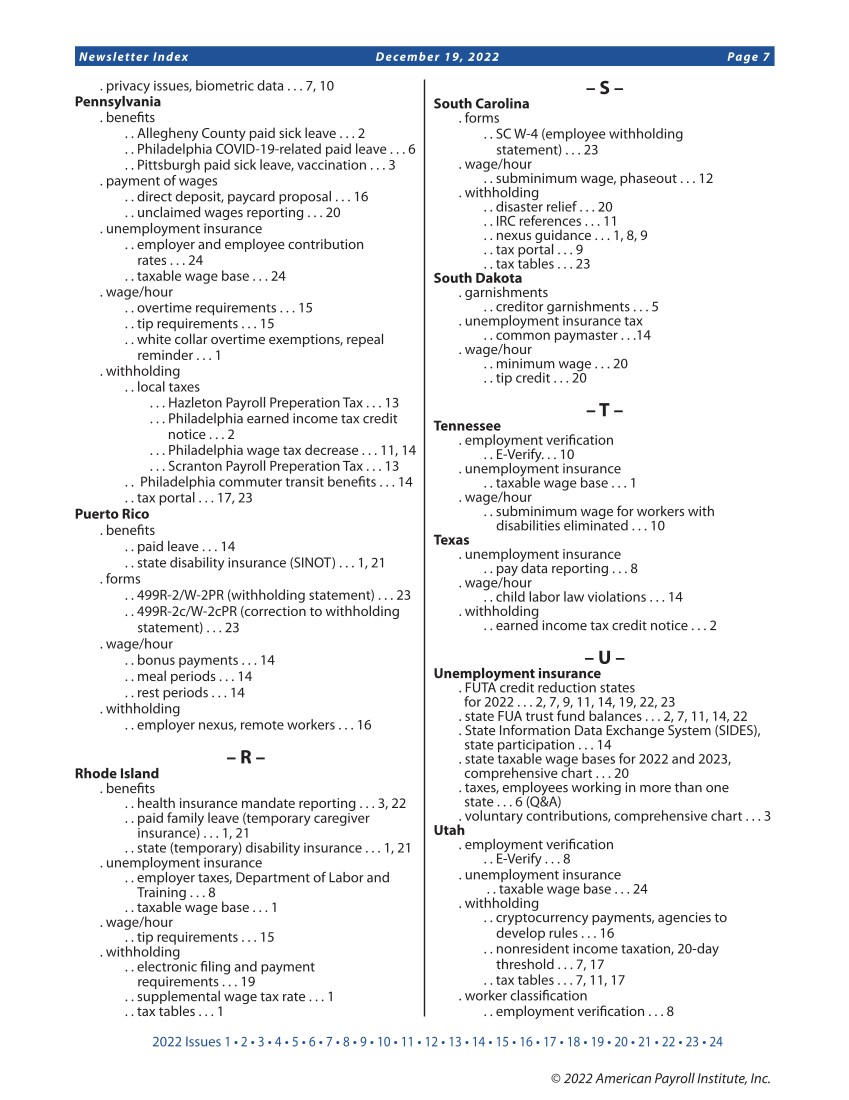

2022 Issues 1 • 2 • 3 • 4 • 5 • 6 • 7 • 8 • 9 • 10 • 11 • 12 • 13 • 14 • 15 • 16 • 17 • 18 • 19 • 20 • 21 • 22 • 23 • 24 Newsletter Index December 19, 2022 Page 7 © 2022 American Payroll Institute, Inc. . privacy issues, biometric data . . . 7, 10 Pennsylvania . benefits . . Allegheny County paid sick leave . . . 2 . . Philadelphia COVID-19-related paid leave . . . 6 . . Pittsburgh paid sick leave, vaccination . . . 3 . payment of wages . . direct deposit, paycard proposal . . . 16 . . unclaimed wages reporting . . . 20 . unemployment insurance . . employer and employee contribution rates . . . 24 . . taxable wage base . . . 24 . wage/hour . . overtime requirements . . . 15 . . tip requirements . . . 15 . . white collar overtime exemptions, repeal reminder . . . 1 . withholding . . local taxes . . . Hazleton Payroll Preperation Tax . . . 13 . . . Philadelphia earned income tax credit notice . . . 2 . . . Philadelphia wage tax decrease . . . 11, 14 . . . Scranton Payroll Preperation Tax . . . 13 . . Philadelphia commuter transit benefits . . . 14 . . tax portal . . . 17, 23 Puerto Rico . benefits . . paid leave . . . 14 . . state disability insurance (SINOT) . . . 1, 21 . forms . . 499R-2/W-2PR (withholding statement) . . . 23 . . 499R-2c/W-2cPR (correction to withholding statement) . . . 23 . wage/hour . . bonus payments . . . 14 . . meal periods . . . 14 . . rest periods . . . 14 . withholding . . employer nexus, remote workers . . . 16 – R – Rhode Island . benefits . . health insurance mandate reporting . . . 3, 22 . . paid family leave (temporary caregiver insurance) . . . 1, 21 . . state (temporary) disability insurance . . . 1, 21 . unemployment insurance . . employer taxes, Department of Labor and Training . . . 8 . . taxable wage base . . . 1 . wage/hour . . tip requirements . . . 15 . withholding . . electronic filing and payment requirements . . . 19 . . supplemental wage tax rate . . . 1 . . tax tables . . . 1 – S – South Carolina . forms . . SC W-4 (employee withholding statement) . . . 23 . wage/hour . . subminimum wage, phaseout . . . 12 . withholding . . disaster relief . . . 20 . . IRC references . . . 11 . . nexus guidance . . . 1, 8, 9 . . tax portal . . . 9 . . tax tables . . . 23 South Dakota . garnishments . . creditor garnishments . . . 5 . unemployment insurance tax . . common paymaster . . .14 . wage/hour . . minimum wage . . . 20 . . tip credit . . . 20 – T – Tennessee . employment verification . . E-Verify. . . 10 . unemployment insurance . . taxable wage base . . . 1 . wage/hour . . subminimum wage for workers with disabilities eliminated . . . 10 Texas . unemployment insurance . . pay data reporting . . . 8 . wage/hour . . child labor law violations . . . 14 . withholding . . earned income tax credit notice . . . 2 – U – Unemployment insurance . FUTA credit reduction states for 2022 . . . 2, 7, 9, 11, 14, 19, 22, 23 . state FUA trust fund balances . . . 2, 7, 11, 14, 22 . State Information Data Exchange System (SIDES), state participation . . . 14 . state taxable wage bases for 2022 and 2023, comprehensive chart . . . 20 . taxes, employees working in more than one state . . . 6 (Q&A) . voluntary contributions, comprehensive chart . . . 3 Utah . employment verification . . E-Verify . . . 8 . unemployment insurance . . taxable wage base . . . 24 . withholding . . cryptocurrency payments, agencies to develop rules . . . 16 . . nonresident income taxation, 20-day threshold . . . 7, 17 . . tax tables . . . 7, 11, 17 . worker classification . . employment verification . . . 8

Printed for: PayrollOrg Bookshelf © 2024 American Payroll Institute, Inc. All Rights reserved. From: PayrollOrg Digital Publications (bookshelf.payroll.org)