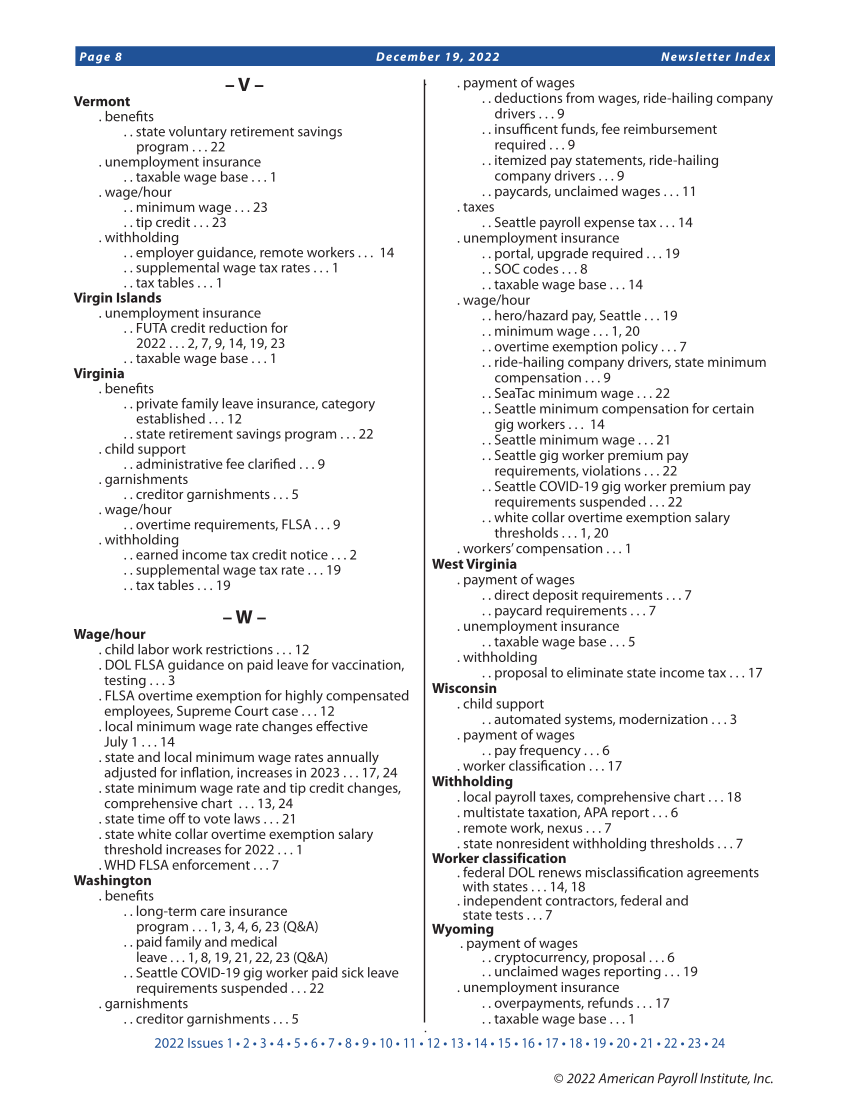

2022 Issues 1 • 2 • 3 • 4 • 5 • 6 • 7 • 8 • 9 • 10 • 11 • 12 • 13 • 14 • 15 • 16 • 17 • 18 • 19 • 20 • 21 • 22 • 23 • 24 Page 8 December 19, 2022 Newsletter Index © 2022 American Payroll Institute, Inc. – V – Vermont . benefits . . state voluntary retirement savings program . . . 22 . unemployment insurance . . taxable wage base . . . 1 . wage/hour . . minimum wage . . . 23 . . tip credit . . . 23 . withholding . . employer guidance, remote workers . . . 14 . . supplemental wage tax rates . . . 1 . . tax tables . . . 1 Virgin Islands . unemployment insurance . . FUTA credit reduction for 2022 . . . 2, 7, 9, 14, 19, 23 . . taxable wage base . . . 1 Virginia . benefits . . private family leave insurance, category established . . . 12 . . state retirement savings program . . . 22 . child support . . administrative fee clarified . . . 9 . garnishments . . creditor garnishments . . . 5 . wage/hour . . overtime requirements, FLSA . . . 9 . withholding . . earned income tax credit notice . . . 2 . . supplemental wage tax rate . . . 19 . . tax tables . . . 19 – W – Wage/hour . child labor work restrictions . . . 12 . DOL FLSA guidance on paid leave for vaccination, testing . . . 3 . FLSA overtime exemption for highly compensated employees, Supreme Court case . . . 12 . local minimum wage rate changes effective July 1 . . . 14 . state and local minimum wage rates annually adjusted for inflation, increases in 2023 . . . 17, 24 . state minimum wage rate and tip credit changes, comprehensive chart . . . 13, 24 . state time off to vote laws . . . 21 . state white collar overtime exemption salary threshold increases for 2022 . . . 1 . WHD FLSA enforcement . . . 7 Washington . benefits . . long-term care insurance program . . . 1, 3, 4, 6, 23 (Q&A) . . paid family and medical leave . . . 1, 8, 19, 21, 22, 23 (Q&A) . . Seattle COVID-19 gig worker paid sick leave requirements suspended . . . 22 . garnishments . . creditor garnishments . . . 5 . payment of wages . . deductions from wages, ride-hailing company drivers . . . 9 . . insufficent funds, fee reimbursement required . . . 9 . . itemized pay statements, ride-hailing company drivers . . . 9 . . paycards, unclaimed wages . . . 11 . taxes . . Seattle payroll expense tax . . . 14 . unemployment insurance . . portal, upgrade required . . . 19 . . SOC codes . . . 8 . . taxable wage base . . . 14 . wage/hour . . hero/hazard pay, Seattle . . . 19 . . minimum wage . . . 1, 20 . . overtime exemption policy . . . 7 . . ride-hailing company drivers, state minimum compensation . . . 9 . . SeaTac minimum wage . . . 22 . . Seattle minimum compensation for certain gig workers . . . 14 . . Seattle minimum wage . . . 21 . . Seattle gig worker premium pay requirements, violations . . . 22 . . Seattle COVID-19 gig worker premium pay requirements suspended . . . 22 . . white collar overtime exemption salary thresholds . . . 1, 20 . workers’ compensation . . . 1 West Virginia . payment of wages . . direct deposit requirements . . . 7 . . paycard requirements . . . 7 . unemployment insurance . . taxable wage base . . . 5 . withholding . . proposal to eliminate state income tax . . . 17 Wisconsin . child support . . automated systems, modernization . . . 3 . payment of wages . . pay frequency . . . 6 . worker classification . . . 17 Withholding . local payroll taxes, comprehensive chart . . . 18 . multistate taxation, APA report . . . 6 . remote work, nexus . . . 7 . state nonresident withholding thresholds . . . 7 Worker classification . federal DOL renews misclassification agreements with states . . . 14, 18 . independent contractors, federal and state tests . . . 7 Wyoming . payment of wages . . cryptocurrency, proposal . . . 6 . . unclaimed wages reporting . . . 19 . unemployment insurance . . overpayments, refunds . . . 17 . . taxable wage base . . . 1

Printed for: PayrollOrg Bookshelf © 2024 American Payroll Institute, Inc. All Rights reserved. From: PayrollOrg Digital Publications (bookshelf.payroll.org)