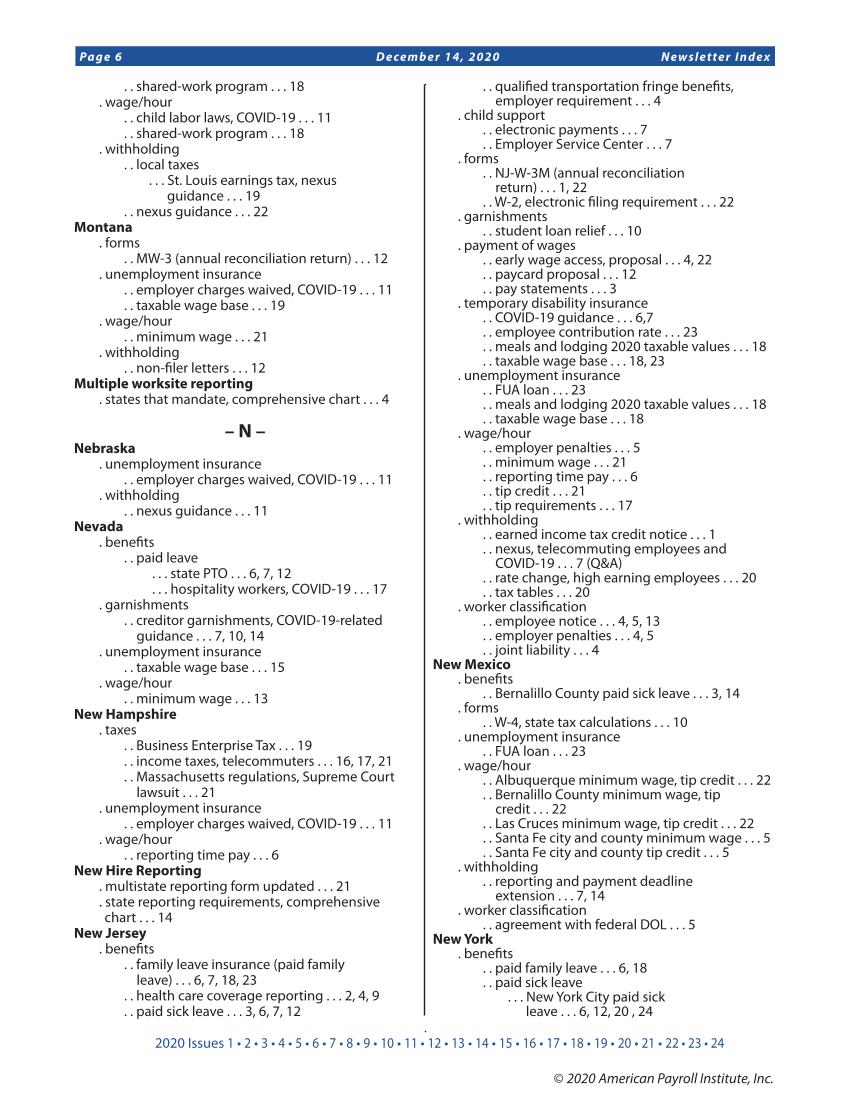

2020 Issues 1 • 2 • 3 • 4 • 5 • 6 • 7 • 8 • 9 • 10 • 11 • 12 • 13 • 14 • 15 • 16 • 17 • 18 • 19 • 20 • 21 • 22 • 23 • 24 Page 6 December 14, 2020 Newsletter Index © 2020 American Payroll Institute, Inc. . . shared-work program . . . 18 . wage/hour . . child labor laws, COVID-19 . . . 11 . . shared-work program . . . 18 . withholding . . local taxes . . . St. Louis earnings tax, nexus guidance . . . 19 . . nexus guidance . . . 22 Montana . forms . . MW-3 (annual reconciliation return) . . . 12 . unemployment insurance . . employer charges waived, COVID-19 . . . 11 . . taxable wage base . . . 19 . wage/hour . . minimum wage . . . 21 . withholding . . non-filer letters . . . 12 Multiple worksite reporting . states that mandate, comprehensive chart . . . 4 – N – Nebraska . unemployment insurance . . employer charges waived, COVID-19 . . . 11 . withholding . . nexus guidance . . . 11 Nevada . benefits . . paid leave . . . state PTO . . . 6, 7, 12 . . . hospitality workers, COVID-19 . . . 17 . garnishments . . creditor garnishments, COVID-19-related guidance . . . 7, 10, 14 . unemployment insurance . . taxable wage base . . . 15 . wage/hour . . minimum wage . . . 13 New Hampshire . taxes . . Business Enterprise Tax . . . 19 . . income taxes, telecommuters . . . 16, 17, 21 . . Massachusetts regulations, Supreme Court lawsuit . . . 21 . unemployment insurance . . employer charges waived, COVID-19 . . . 11 . wage/hour . . reporting time pay . . . 6 New Hire Reporting . multistate reporting form updated . . . 21 . state reporting requirements, comprehensive chart . . . 14 New Jersey . benefits . . family leave insurance (paid family leave) . . . 6, 7, 18, 23 . . health care coverage reporting . . . 2, 4, 9 . . paid sick leave . . . 3, 6, 7, 12 . . qualified transportation fringe benefits, employer requirement . . . 4 . child support . . electronic payments . . . 7 . . Employer Service Center . . . 7 . forms . . NJ-W-3M (annual reconciliation return) . . . 1, 22 . . W-2, electronic filing requirement . . . 22 . garnishments . . student loan relief . . . 10 . payment of wages . . early wage access, proposal . . . 4, 22 . . paycard proposal . . . 12 . . pay statements . . . 3 . temporary disability insurance . . COVID-19 guidance . . . 6,7 . . employee contribution rate . . . 23 . . meals and lodging 2020 taxable values . . . 18 . . taxable wage base . . . 18, 23 . unemployment insurance . . FUA loan . . . 23 . . meals and lodging 2020 taxable values . . . 18 . . taxable wage base . . . 18 . wage/hour . . employer penalties . . . 5 . . minimum wage . . . 21 . . reporting time pay . . . 6 . . tip credit . . . 21 . . tip requirements . . . 17 . withholding . . earned income tax credit notice . . . 1 . . nexus, telecommuting employees and COVID-19 . . . 7 (Q&A) . . rate change, high earning employees . . . 20 . . tax tables . . . 20 . worker classification . . employee notice . . . 4, 5, 13 . . employer penalties . . . 4, 5 . . joint liability . . . 4 New Mexico . benefits . . Bernalillo County paid sick leave . . . 3, 14 . forms . . W-4, state tax calculations . . . 10 . unemployment insurance . . FUA loan . . . 23 . wage/hour . . Albuquerque minimum wage, tip credit . . . 22 . . Bernalillo County minimum wage, tip credit . . . 22 . . Las Cruces minimum wage, tip credit . . . 22 . . Santa Fe city and county minimum wage . . . 5 . . Santa Fe city and county tip credit . . . 5 . withholding . . reporting and payment deadline extension . . . 7, 14 . worker classification . . agreement with federal DOL . . . 5 New York . benefits . . paid family leave . . . 6, 18 . . paid sick leave . . . New York City paid sick leave . . . 6, 12, 20 , 24

Printed for: PayrollOrg Bookshelf © 2024 American Payroll Institute, Inc. All Rights reserved. From: PayrollOrg Digital Publications (bookshelf.payroll.org)