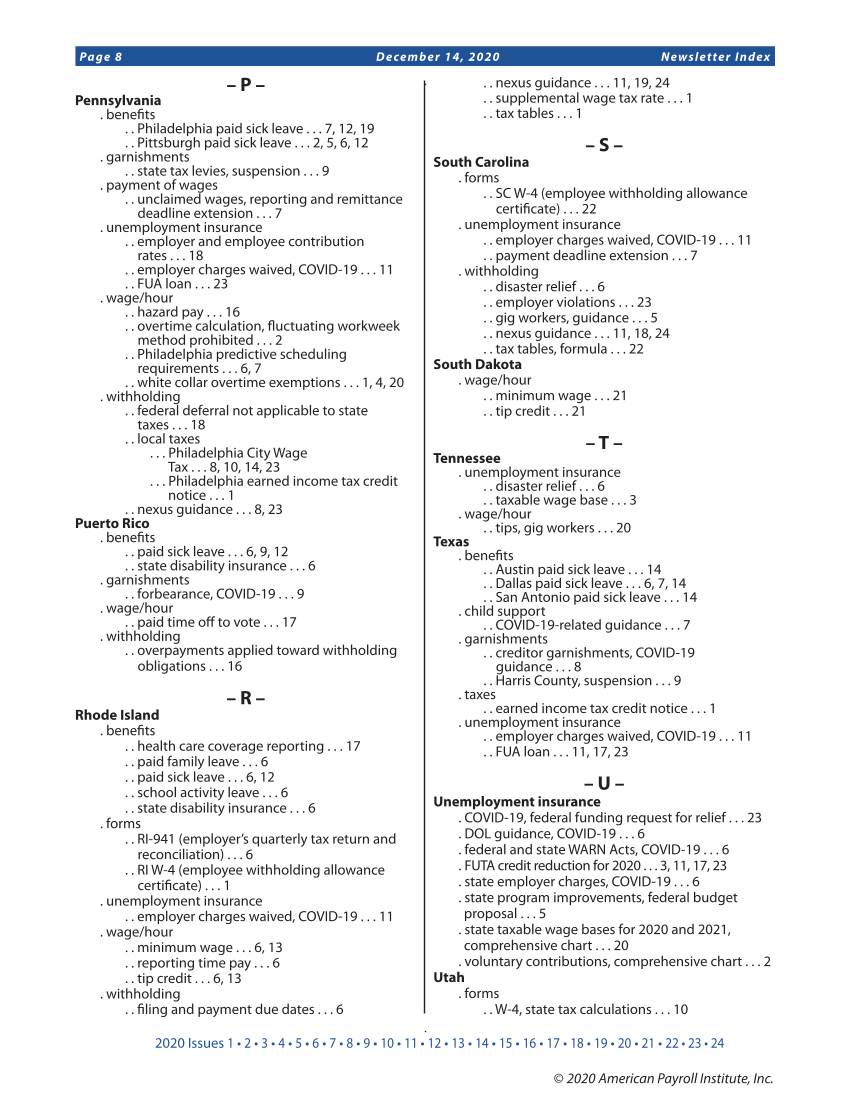

2020 Issues 1 • 2 • 3 • 4 • 5 • 6 • 7 • 8 • 9 • 10 • 11 • 12 • 13 • 14 • 15 • 16 • 17 • 18 • 19 • 20 • 21 • 22 • 23 • 24 Page 8 December 14, 2020 Newsletter Index © 2020 American Payroll Institute, Inc. – P – Pennsylvania . benefits . . Philadelphia paid sick leave . . . 7, 12, 19 . . Pittsburgh paid sick leave . . . 2, 5, 6, 12 . garnishments . . state tax levies, suspension . . . 9 . payment of wages . . unclaimed wages, reporting and remittance deadline extension . . . 7 . unemployment insurance . . employer and employee contribution rates . . . 18 . . employer charges waived, COVID-19 . . . 11 . . FUA loan . . . 23 . wage/hour . . hazard pay . . . 16 . . overtime calculation, fluctuating workweek method prohibited . . . 2 . . Philadelphia predictive scheduling requirements . . . 6, 7 . . white collar overtime exemptions . . . 1, 4, 20 . withholding . . federal deferral not applicable to state taxes . . . 18 . . local taxes . . . Philadelphia City Wage Tax . . . 8, 10, 14, 23 . . . Philadelphia earned income tax credit notice . . . 1 . . nexus guidance . . . 8, 23 Puerto Rico . benefits . . paid sick leave . . . 6, 9, 12 . . state disability insurance . . . 6 . garnishments . . forbearance, COVID-19 . . . 9 . wage/hour . . paid time off to vote . . . 17 . withholding . . overpayments applied toward withholding obligations . . . 16 – R – Rhode Island . benefits . . health care coverage reporting . . . 17 . . paid family leave . . . 6 . . paid sick leave . . . 6, 12 . . school activity leave . . . 6 . . state disability insurance . . . 6 . forms . . RI-941 (employer’s quarterly tax return and reconciliation) . . . 6 . . RI W-4 (employee withholding allowance certificate) . . . 1 . unemployment insurance . . employer charges waived, COVID-19 . . . 11 . wage/hour . . minimum wage . . . 6, 13 . . reporting time pay . . . 6 . . tip credit . . . 6, 13 . withholding . . filing and payment due dates . . . 6 . . nexus guidance . . . 11, 19, 24 . . supplemental wage tax rate . . . 1 . . tax tables . . . 1 – S – South Carolina . forms . . SC W-4 (employee withholding allowance certificate) . . . 22 . unemployment insurance . . employer charges waived, COVID-19 . . . 11 . . payment deadline extension . . . 7 . withholding . . disaster relief . . . 6 . . employer violations . . . 23 . . gig workers, guidance . . . 5 . . nexus guidance . . . 11, 18, 24 . . tax tables, formula . . . 22 South Dakota . wage/hour . . minimum wage . . . 21 . . tip credit . . . 21 – T – Tennessee . unemployment insurance . . disaster relief . . . 6 . . taxable wage base . . . 3 . wage/hour . . tips, gig workers . . . 20 Texas . benefits . . Austin paid sick leave . . . 14 . . Dallas paid sick leave . . . 6, 7, 14 . . San Antonio paid sick leave . . . 14 . child support . . COVID-19-related guidance . . . 7 . garnishments . . creditor garnishments, COVID-19 guidance . . . 8 . . Harris County, suspension . . . 9 . taxes . . earned income tax credit notice . . . 1 . unemployment insurance . . employer charges waived, COVID-19 . . . 11 . . FUA loan . . . 11, 17, 23 – U – Unemployment insurance . COVID-19, federal funding request for relief . . . 23 . DOL guidance, COVID-19 . . . 6 . federal and state WARN Acts, COVID-19 . . . 6 . FUTA credit reduction for 2020 . . . 3, 11, 17, 23 . state employer charges, COVID-19 . . . 6 . state program improvements, federal budget proposal . . . 5 . state taxable wage bases for 2020 and 2021, comprehensive chart . . . 20 . voluntary contributions, comprehensive chart . . . 2 Utah . forms . . W-4, state tax calculations . . . 10

Printed for: PayrollOrg Bookshelf © 2024 American Payroll Institute, Inc. All Rights reserved. From: PayrollOrg Digital Publications (bookshelf.payroll.org)