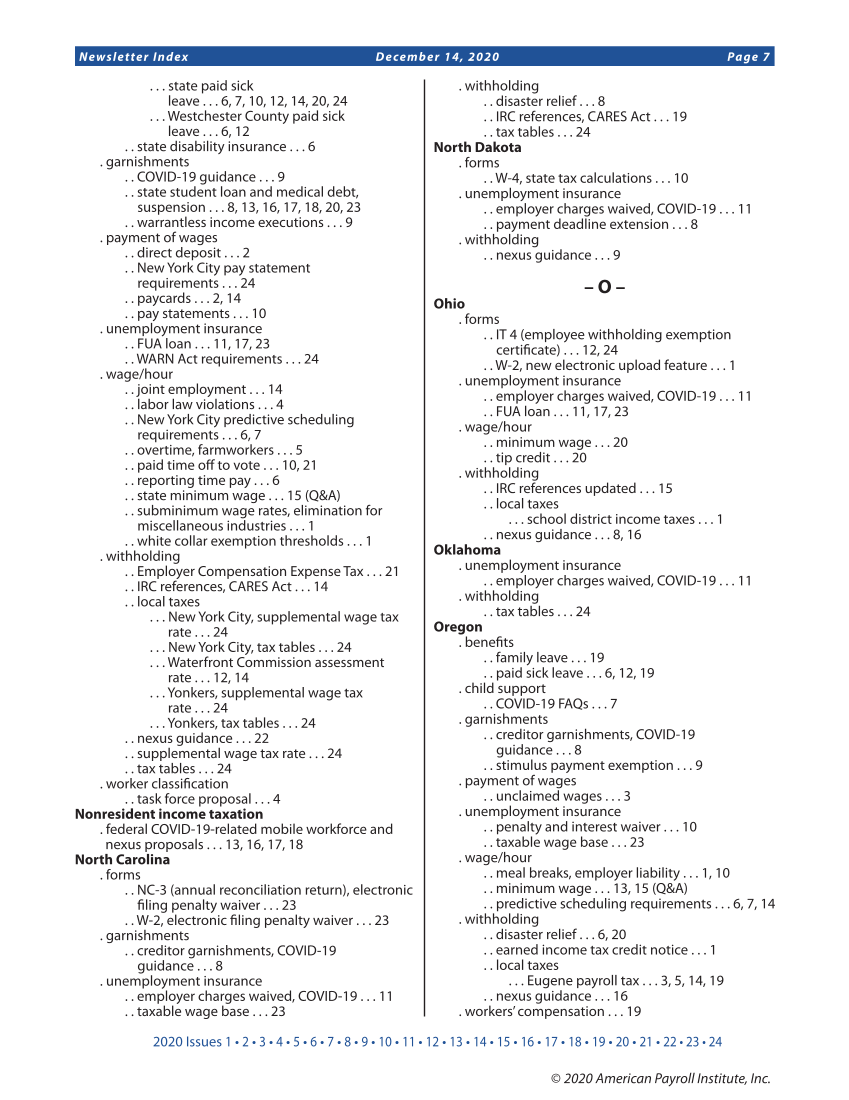

2020 Issues 1 • 2 • 3 • 4 • 5 • 6 • 7 • 8 • 9 • 10 • 11 • 12 • 13 • 14 • 15 • 16 • 17 • 18 • 19 • 20 • 21 • 22 • 23 • 24 Newsletter Index December 14, 2020 Page 7 © 2020 American Payroll Institute, Inc. . . . state paid sick leave . . . 6, 7, 10, 12, 14, 20, 24 . . . Westchester County paid sick leave . . . 6, 12 . . state disability insurance . . . 6 . garnishments . . COVID-19 guidance . . . 9 . . state student loan and medical debt, suspension . . . 8, 13, 16, 17, 18, 20, 23 . . warrantless income executions . . . 9 . payment of wages . . direct deposit . . . 2 . . New York City pay statement requirements . . . 24 . . paycards . . . 2, 14 . . pay statements . . . 10 . unemployment insurance . . FUA loan . . . 11, 17, 23 . . WARN Act requirements . . . 24 . wage/hour . . joint employment . . . 14 . . labor law violations . . . 4 . . New York City predictive scheduling requirements . . . 6, 7 . . overtime, farmworkers . . . 5 . . paid time off to vote . . . 10, 21 . . reporting time pay . . . 6 . . state minimum wage . . . 15 (Q&A) . . subminimum wage rates, elimination for miscellaneous industries . . . 1 . . white collar exemption thresholds . . . 1 . withholding . . Employer Compensation Expense Tax . . . 21 . . IRC references, CARES Act . . . 14 . . local taxes . . . New York City, supplemental wage tax rate . . . 24 . . . New York City, tax tables . . . 24 . . . Waterfront Commission assessment rate . . . 12, 14 . . . Yonkers, supplemental wage tax rate . . . 24 . . . Yonkers, tax tables . . . 24 . . nexus guidance . . . 22 . . supplemental wage tax rate . . . 24 . . tax tables . . . 24 . worker classification . . task force proposal . . . 4 Nonresident income taxation . federal COVID-19-related mobile workforce and nexus proposals . . . 13, 16, 17, 18 North Carolina . forms . . NC-3 (annual reconciliation return), electronic filing penalty waiver . . . 23 . . W-2, electronic filing penalty waiver . . . 23 . garnishments . . creditor garnishments, COVID-19 guidance . . . 8 . unemployment insurance . . employer charges waived, COVID-19 . . . 11 . . taxable wage base . . . 23 . withholding . . disaster relief . . . 8 . . IRC references, CARES Act . . . 19 . . tax tables . . . 24 North Dakota . forms . . W-4, state tax calculations . . . 10 . unemployment insurance . . employer charges waived, COVID-19 . . . 11 . . payment deadline extension . . . 8 . withholding . . nexus guidance . . . 9 – O – Ohio . forms . . IT 4 (employee withholding exemption certificate) . . . 12, 24 . . W-2, new electronic upload feature . . . 1 . unemployment insurance . . employer charges waived, COVID-19 . . . 11 . . FUA loan . . . 11, 17, 23 . wage/hour . . minimum wage . . . 20 . . tip credit . . . 20 . withholding . . IRC references updated . . . 15 . . local taxes . . . school district income taxes . . . 1 . . nexus guidance . . . 8, 16 Oklahoma . unemployment insurance . . employer charges waived, COVID-19 . . . 11 . withholding . . tax tables . . . 24 Oregon . benefits . . family leave . . . 19 . . paid sick leave . . . 6, 12, 19 . child support . . COVID-19 FAQs . . . 7 . garnishments . . creditor garnishments, COVID-19 guidance . . . 8 . . stimulus payment exemption . . . 9 . payment of wages . . unclaimed wages . . . 3 . unemployment insurance . . penalty and interest waiver . . . 10 . . taxable wage base . . . 23 . wage/hour . . meal breaks, employer liability . . . 1, 10 . . minimum wage . . . 13, 15 (Q&A) . . predictive scheduling requirements . . . 6, 7, 14 . withholding . . disaster relief . . . 6, 20 . . earned income tax credit notice . . . 1 . . local taxes . . . Eugene payroll tax . . . 3, 5, 14, 19 . . nexus guidance . . . 16 . workers’ compensation . . . 19

Printed for: PayrollOrg Bookshelf © 2024 American Payroll Institute, Inc. All Rights reserved. From: PayrollOrg Digital Publications (bookshelf.payroll.org)