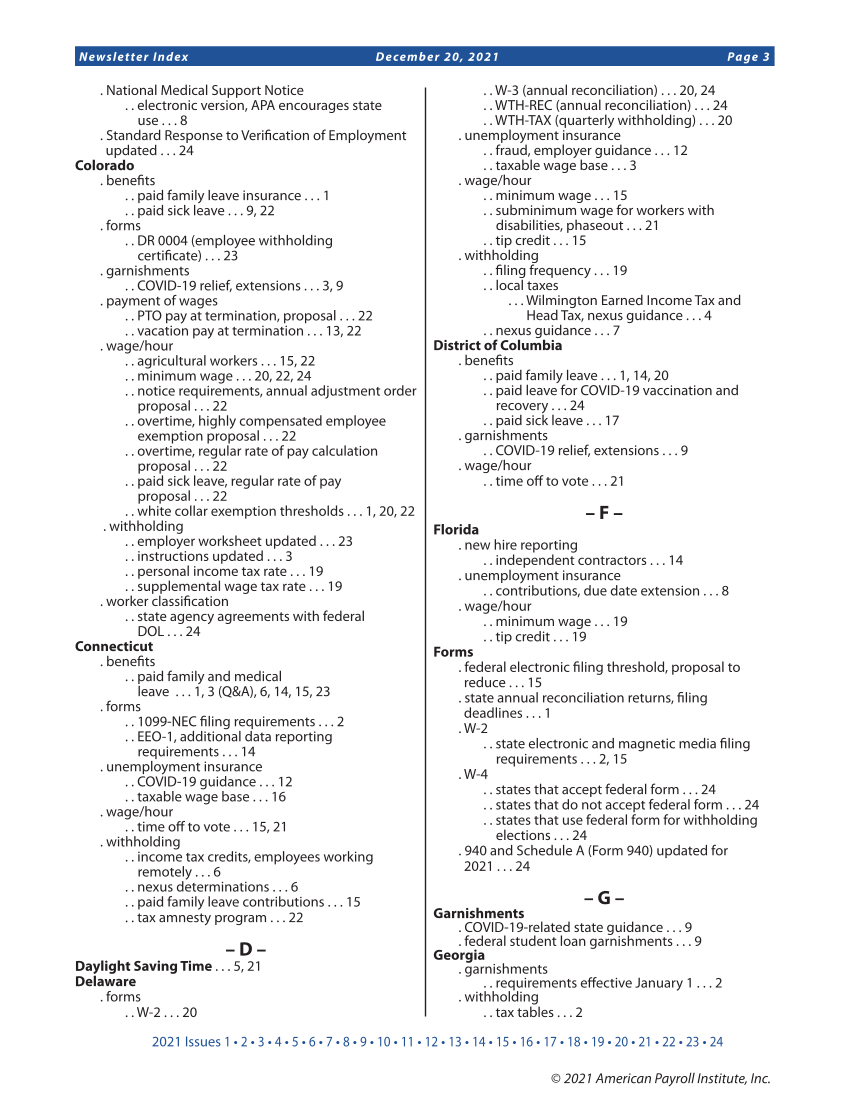

2021 Issues 1 • 2 • 3 • 4 • 5 • 6 • 7 • 8 • 9 • 10 • 11 • 12 • 13 • 14 • 15 • 16 • 17 • 18 • 19 • 20 • 21 • 22 • 23 • 24 Newsletter Index December 20, 2021 Page 3 © 2021 American Payroll Institute, Inc. . National Medical Support Notice . . electronic version, APA encourages state use . . . 8 . Standard Response to Verification of Employment updated . . . 24 Colorado . benefits . . paid family leave insurance . . . 1 . . paid sick leave . . . 9, 22 . forms . . DR 0004 (employee withholding certificate) . . . 23 . garnishments . . COVID-19 relief, extensions . . . 3, 9 . payment of wages . . PTO pay at termination, proposal . . . 22 . . vacation pay at termination . . . 13, 22 . wage/hour . . agricultural workers . . . 15, 22 . . minimum wage . . . 20, 22, 24 . . notice requirements, annual adjustment order proposal . . . 22 . . overtime, highly compensated employee exemption proposal . . . 22 . . overtime, regular rate of pay calculation proposal . . . 22 . . paid sick leave, regular rate of pay proposal . . . 22 . . white collar exemption thresholds . . . 1, 20, 22 . withholding . . employer worksheet updated . . . 23 . . instructions updated . . . 3 . . personal income tax rate . . . 19 . . supplemental wage tax rate . . . 19 . worker classification . . state agency agreements with federal DOL . . . 24 Connecticut . benefits . . paid family and medical leave . . . 1, 3 (Q&A), 6, 14, 15, 23 . forms . . 1099-NEC filing requirements . . . 2 . . EEO-1, additional data reporting requirements . . . 14 . unemployment insurance . . COVID-19 guidance . . . 12 . . taxable wage base . . . 16 . wage/hour . . time off to vote . . . 15, 21 . withholding . . income tax credits, employees working remotely . . . 6 . . nexus determinations . . . 6 . . paid family leave contributions . . . 15 . . tax amnesty program . . . 22 – D – Daylight Saving Time . . . 5, 21 Delaware . forms . . W-2 . . . 20 . . W-3 (annual reconciliation) . . . 20, 24 . . WTH-REC (annual reconciliation) . . . 24 . . WTH-TAX (quarterly withholding) . . . 20 . unemployment insurance . . fraud, employer guidance . . . 12 . . taxable wage base . . . 3 . wage/hour . . minimum wage . . . 15 . . subminimum wage for workers with disabilities, phaseout . . . 21 . . tip credit . . . 15 . withholding . . filing frequency . . . 19 . . local taxes . . . Wilmington Earned Income Tax and Head Tax, nexus guidance . . . 4 . . nexus guidance . . . 7 District of Columbia . benefits . . paid family leave . . . 1, 14, 20 . . paid leave for COVID-19 vaccination and recovery . . . 24 . . paid sick leave . . . 17 . garnishments . . COVID-19 relief, extensions . . . 9 . wage/hour . . time off to vote . . . 21 – F – Florida . new hire reporting . . independent contractors . . . 14 . unemployment insurance . . contributions, due date extension . . . 8 . wage/hour . . minimum wage . . . 19 . . tip credit . . . 19 Forms . federal electronic filing threshold, proposal to reduce . . . 15 . state annual reconciliation returns, filing deadlines . . . 1 . W-2 . . state electronic and magnetic media filing requirements . . . 2, 15 . W-4 . . states that accept federal form . . . 24 . . states that do not accept federal form . . . 24 . . states that use federal form for withholding elections . . . 24 . 940 and Schedule A (Form 940) updated for 2021 . . . 24 – G – Garnishments . COVID-19-related state guidance . . . 9 . federal student loan garnishments . . . 9 Georgia . garnishments . . requirements effective January 1 . . . 2 . withholding . . tax tables . . . 2

Printed for: PayrollOrg Bookshelf © 2024 American Payroll Institute, Inc. All Rights reserved. From: PayrollOrg Digital Publications (bookshelf.payroll.org)