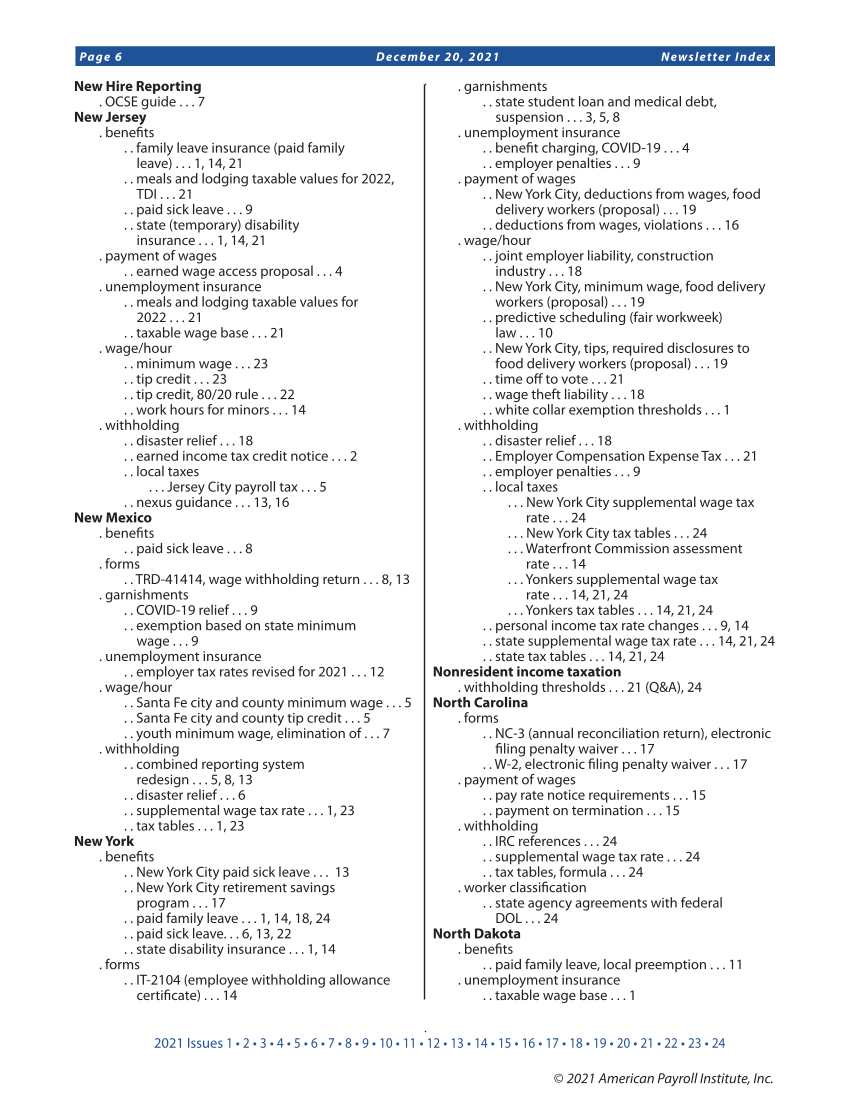

2021 Issues 1 • 2 • 3 • 4 • 5 • 6 • 7 • 8 • 9 • 10 • 11 • 12 • 13 • 14 • 15 • 16 • 17 • 18 • 19 • 20 • 21 • 22 • 23 • 24 Page 6 December 20, 2021 Newsletter Index © 2021 American Payroll Institute, Inc. New Hire Reporting . OCSE guide . . . 7 New Jersey . benefits . . family leave insurance (paid family leave) . . . 1, 14, 21 . . meals and lodging taxable values for 2022, TDI . . . 21 . . paid sick leave . . . 9 . . state (temporary) disability insurance . . . 1, 14, 21 . payment of wages . . earned wage access proposal . . . 4 . unemployment insurance . . meals and lodging taxable values for 2022 . . . 21 . . taxable wage base . . . 21 . wage/hour . . minimum wage . . . 23 . . tip credit . . . 23 . . tip credit, 80/20 rule . . . 22 . . work hours for minors . . . 14 . withholding . . disaster relief . . . 18 . . earned income tax credit notice . . . 2 . . local taxes . . . Jersey City payroll tax . . . 5 . . nexus guidance . . . 13, 16 New Mexico . benefits . . paid sick leave . . . 8 . forms . . TRD-41414, wage withholding return . . . 8, 13 . garnishments . . COVID-19 relief . . . 9 . . exemption based on state minimum wage . . . 9 . unemployment insurance . . employer tax rates revised for 2021 . . . 12 . wage/hour . . Santa Fe city and county minimum wage . . . 5 . . Santa Fe city and county tip credit . . . 5 . . youth minimum wage, elimination of . . . 7 . withholding . . combined reporting system redesign . . . 5, 8, 13 . . disaster relief . . . 6 . . supplemental wage tax rate . . . 1, 23 . . tax tables . . . 1, 23 New York . benefits . . New York City paid sick leave . . . 13 . . New York City retirement savings program . . . 17 . . paid family leave . . . 1, 14, 18, 24 . . paid sick leave. . . 6, 13, 22 . . state disability insurance . . . 1, 14 . forms . . IT-2104 (employee withholding allowance certificate) . . . 14 . garnishments . . state student loan and medical debt, suspension . . . 3, 5, 8 . unemployment insurance . . benefit charging, COVID-19 . . . 4 . . employer penalties . . . 9 . payment of wages . . New York City, deductions from wages, food delivery workers (proposal) . . . 19 . . deductions from wages, violations . . . 16 . wage/hour . . joint employer liability, construction industry . . . 18 . . New York City, minimum wage, food delivery workers (proposal) . . . 19 . . predictive scheduling (fair workweek) law . . . 10 . . New York City, tips, required disclosures to food delivery workers (proposal) . . . 19 . . time off to vote . . . 21 . . wage theft liability . . . 18 . . white collar exemption thresholds . . . 1 . withholding . . disaster relief . . . 18 . . Employer Compensation Expense Tax . . . 21 . . employer penalties . . . 9 . . local taxes . . . New York City supplemental wage tax rate . . . 24 . . . New York City tax tables . . . 24 . . . Waterfront Commission assessment rate . . . 14 . . . Yonkers supplemental wage tax rate . . . 14, 21, 24 . . . Yonkers tax tables . . . 14, 21, 24 . . personal income tax rate changes . . . 9, 14 . . state supplemental wage tax rate . . . 14, 21, 24 . . state tax tables . . . 14, 21, 24 Nonresident income taxation . withholding thresholds . . . 21 (Q&A), 24 North Carolina . forms . . NC-3 (annual reconciliation return), electronic filing penalty waiver . . . 17 . . W-2, electronic filing penalty waiver . . . 17 . payment of wages . . pay rate notice requirements . . . 15 . . payment on termination . . . 15 . withholding . . IRC references . . . 24 . . supplemental wage tax rate . . . 24 . . tax tables, formula . . . 24 . worker classification . . state agency agreements with federal DOL . . . 24 North Dakota . benefits . . paid family leave, local preemption . . . 11 . unemployment insurance . . taxable wage base . . . 1

Printed for: PayrollOrg Bookshelf © 2024 American Payroll Institute, Inc. All Rights reserved. From: PayrollOrg Digital Publications (bookshelf.payroll.org)