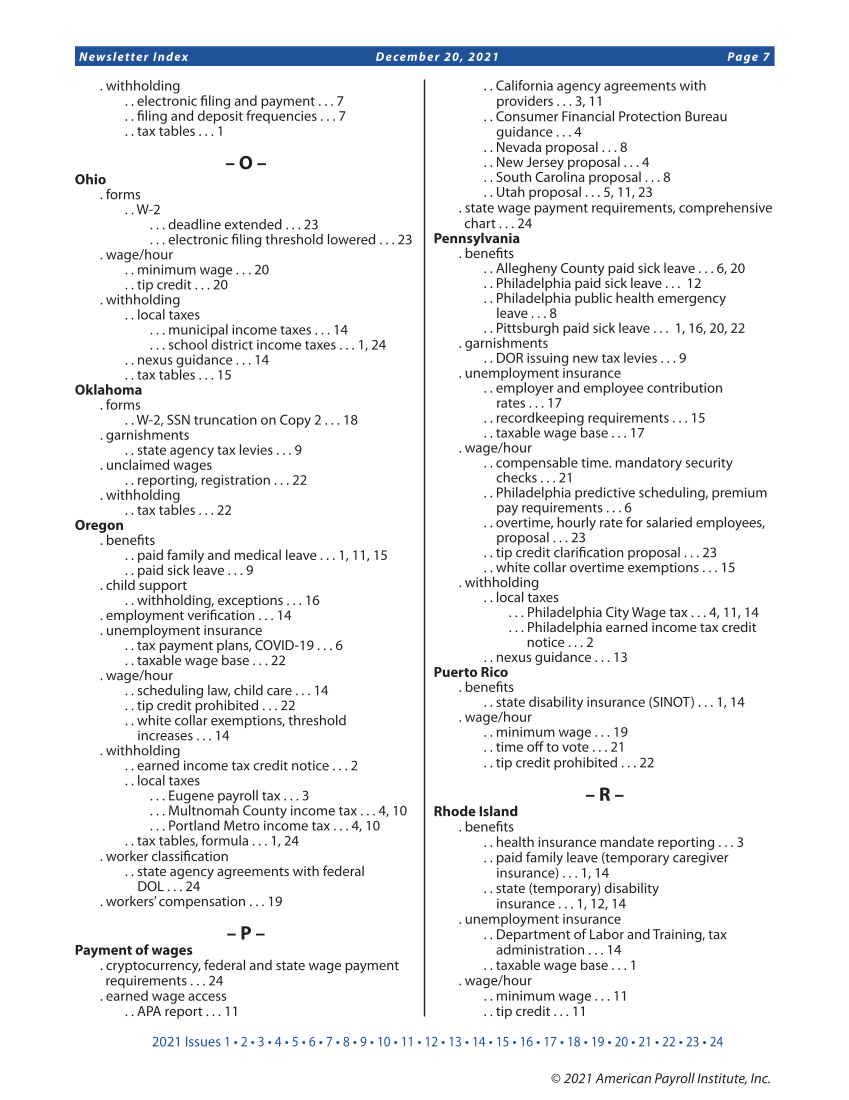

2021 Issues 1 • 2 • 3 • 4 • 5 • 6 • 7 • 8 • 9 • 10 • 11 • 12 • 13 • 14 • 15 • 16 • 17 • 18 • 19 • 20 • 21 • 22 • 23 • 24 Newsletter Index December 20, 2021 Page 7 © 2021 American Payroll Institute, Inc. . withholding . . electronic filing and payment . . . 7 . . filing and deposit frequencies . . . 7 . . tax tables . . . 1 – O – Ohio . forms . . W-2 . . . deadline extended . . . 23 . . . electronic filing threshold lowered . . . 23 . wage/hour . . minimum wage . . . 20 . . tip credit . . . 20 . withholding . . local taxes . . . municipal income taxes . . . 14 . . . school district income taxes . . . 1, 24 . . nexus guidance . . . 14 . . tax tables . . . 15 Oklahoma . forms . . W-2, SSN truncation on Copy 2 . . . 18 . garnishments . . state agency tax levies . . . 9 . unclaimed wages . . reporting, registration . . . 22 . withholding . . tax tables . . . 22 Oregon . benefits . . paid family and medical leave . . . 1, 11, 15 . . paid sick leave . . . 9 . child support . . withholding, exceptions . . . 16 . employment verification . . . 14 . unemployment insurance . . tax payment plans, COVID-19 . . . 6 . . taxable wage base . . . 22 . wage/hour . . scheduling law, child care . . . 14 . . tip credit prohibited . . . 22 . . white collar exemptions, threshold increases . . . 14 . withholding . . earned income tax credit notice . . . 2 . . local taxes . . . Eugene payroll tax . . . 3 . . . Multnomah County income tax . . . 4, 10 . . . Portland Metro income tax . . . 4, 10 . . tax tables, formula . . . 1, 24 . worker classification . . state agency agreements with federal DOL . . . 24 . workers’ compensation . . . 19 – P – Payment of wages . cryptocurrency, federal and state wage payment requirements . . . 24 . earned wage access . . APA report . . . 11 . . California agency agreements with providers . . . 3, 11 . . Consumer Financial Protection Bureau guidance . . . 4 . . Nevada proposal . . . 8 . . New Jersey proposal . . . 4 . . South Carolina proposal . . . 8 . . Utah proposal . . . 5, 11, 23 . state wage payment requirements, comprehensive chart . . . 24 Pennsylvania . benefits . . Allegheny County paid sick leave . . . 6, 20 . . Philadelphia paid sick leave . . . 12 . . Philadelphia public health emergency leave . . . 8 . . Pittsburgh paid sick leave . . . 1, 16, 20, 22 . garnishments . . DOR issuing new tax levies . . . 9 . unemployment insurance . . employer and employee contribution rates . . . 17 . . recordkeeping requirements . . . 15 . . taxable wage base . . . 17 . wage/hour . . compensable time. mandatory security checks . . . 21 . . Philadelphia predictive scheduling, premium pay requirements . . . 6 . . overtime, hourly rate for salaried employees, proposal . . . 23 . . tip credit clarification proposal . . . 23 . . white collar overtime exemptions . . . 15 . withholding . . local taxes . . . Philadelphia City Wage tax . . . 4, 11, 14 . . . Philadelphia earned income tax credit notice . . . 2 . . nexus guidance . . . 13 Puerto Rico . benefits . . state disability insurance (SINOT) . . . 1, 14 . wage/hour . . minimum wage . . . 19 . . time off to vote . . . 21 . . tip credit prohibited . . . 22 – R – Rhode Island . benefits . . health insurance mandate reporting . . . 3 . . paid family leave (temporary caregiver insurance) . . . 1, 14 . . state (temporary) disability insurance . . . 1, 12, 14 . unemployment insurance . . Department of Labor and Training, tax administration . . . 14 . . taxable wage base . . . 1 . wage/hour . . minimum wage . . . 11 . . tip credit . . . 11

Printed for: PayrollOrg Bookshelf © 2024 American Payroll Institute, Inc. All Rights reserved. From: PayrollOrg Digital Publications (bookshelf.payroll.org)