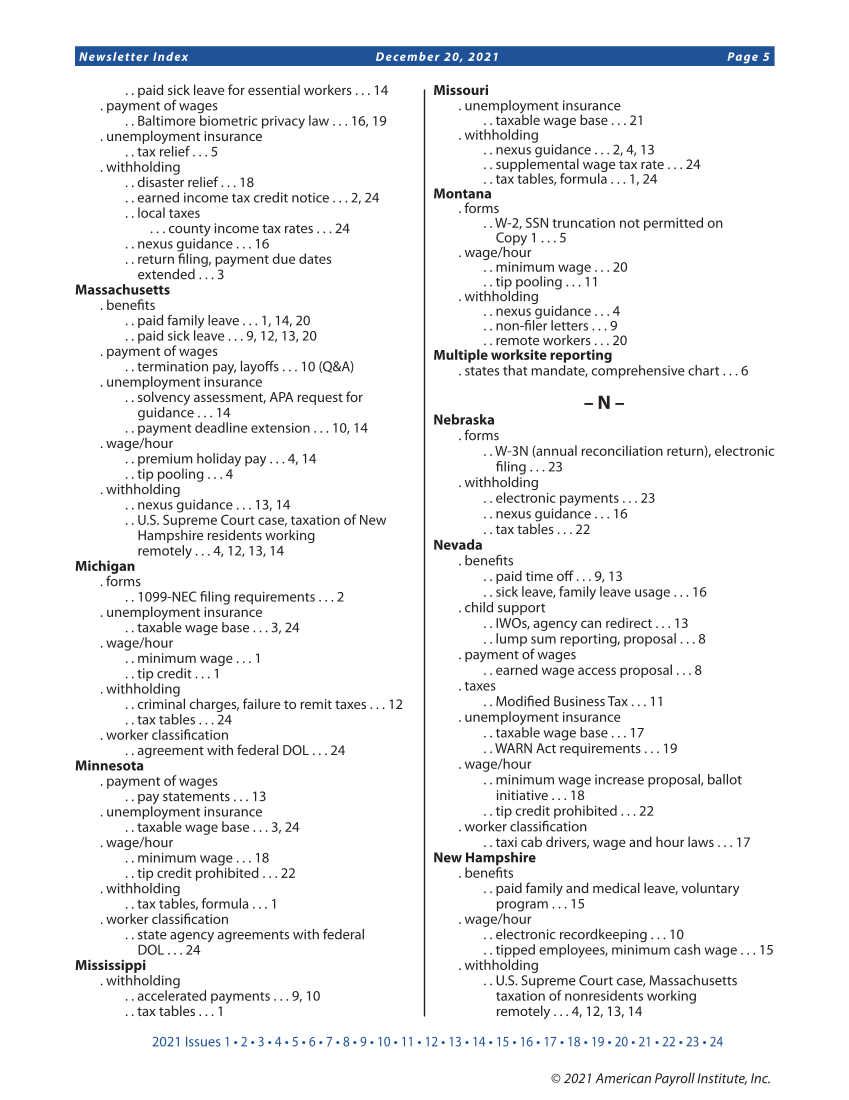

2021 Issues 1 • 2 • 3 • 4 • 5 • 6 • 7 • 8 • 9 • 10 • 11 • 12 • 13 • 14 • 15 • 16 • 17 • 18 • 19 • 20 • 21 • 22 • 23 • 24 Newsletter Index December 20, 2021 Page 5 © 2021 American Payroll Institute, Inc. . . paid sick leave for essential workers . . . 14 . payment of wages . . Baltimore biometric privacy law . . . 16, 19 . unemployment insurance . . tax relief . . . 5 . withholding . . disaster relief . . . 18 . . earned income tax credit notice . . . 2, 24 . . local taxes . . . county income tax rates . . . 24 . . nexus guidance . . . 16 . . return filing, payment due dates extended . . . 3 Massachusetts . benefits . . paid family leave . . . 1, 14, 20 . . paid sick leave . . . 9, 12, 13, 20 . payment of wages . . termination pay, layoffs . . . 10 (Q&A) . unemployment insurance . . solvency assessment, APA request for guidance . . . 14 . . payment deadline extension . . . 10, 14 . wage/hour . . premium holiday pay . . . 4, 14 . . tip pooling . . . 4 . withholding . . nexus guidance . . . 13, 14 . . U.S. Supreme Court case, taxation of New Hampshire residents working remotely . . . 4, 12, 13, 14 Michigan . forms . . 1099-NEC filing requirements . . . 2 . unemployment insurance . . taxable wage base . . . 3, 24 . wage/hour . . minimum wage . . . 1 . . tip credit . . . 1 . withholding . . criminal charges, failure to remit taxes . . . 12 . . tax tables . . . 24 . worker classification . . agreement with federal DOL . . . 24 Minnesota . payment of wages . . pay statements . . . 13 . unemployment insurance . . taxable wage base . . . 3, 24 . wage/hour . . minimum wage . . . 18 . . tip credit prohibited . . . 22 . withholding . . tax tables, formula . . . 1 . worker classification . . state agency agreements with federal DOL . . . 24 Mississippi . withholding . . accelerated payments . . . 9, 10 . . tax tables . . . 1 Missouri . unemployment insurance . . taxable wage base . . . 21 . withholding . . nexus guidance . . . 2, 4, 13 . . supplemental wage tax rate . . . 24 . . tax tables, formula . . . 1, 24 Montana . forms . . W-2, SSN truncation not permitted on Copy 1 . . . 5 . wage/hour . . minimum wage . . . 20 . . tip pooling . . . 11 . withholding . . nexus guidance . . . 4 . . non-filer letters . . . 9 . . remote workers . . . 20 Multiple worksite reporting . states that mandate, comprehensive chart . . . 6 – N – Nebraska . forms . . W-3N (annual reconciliation return), electronic filing . . . 23 . withholding . . electronic payments . . . 23 . . nexus guidance . . . 16 . . tax tables . . . 22 Nevada . benefits . . paid time off . . . 9, 13 . . sick leave, family leave usage . . . 16 . child support . . IWOs, agency can redirect . . . 13 . . lump sum reporting, proposal . . . 8 . payment of wages . . earned wage access proposal . . . 8 . taxes . . Modified Business Tax . . . 11 . unemployment insurance . . taxable wage base . . . 17 . . WARN Act requirements . . . 19 . wage/hour . . minimum wage increase proposal, ballot initiative . . . 18 . . tip credit prohibited . . . 22 . worker classification . . taxi cab drivers, wage and hour laws . . . 17 New Hampshire . benefits . . paid family and medical leave, voluntary program . . . 15 . wage/hour . . electronic recordkeeping . . . 10 . . tipped employees, minimum cash wage . . . 15 . withholding . . U.S. Supreme Court case, Massachusetts taxation of nonresidents working remotely . . . 4, 12, 13, 14

Printed for: PayrollOrg Bookshelf © 2024 American Payroll Institute, Inc. All Rights reserved. From: PayrollOrg Digital Publications (bookshelf.payroll.org)